The industry of a family office has been secretive. Although the concept of what it is and how it operates has been around in different forms for centuries, it is often misunderstood. Even financial professionals who currently manage billions of dollars Assets Under Management (AUM) and have years of experience sometimes cannot offer a complete definition of what a family office is. So what is a family office?

A complete and accurate definition of a family office has been widely debated. According to Family Office Group, a family office is a 360 degree financial and wealth management firm for the ultra-affluent, and provides families a wide range of comprehensive services and solutions including investment, insurance, taxation, philanthropy, and multi-generation guidance on wealth structuring and transfer.

The (Securities & Exchange Commission) SEC also defines single family offices as “entities established by wealthy families to manage their wealth and provide other services to family members, such as tax and estate planning services.

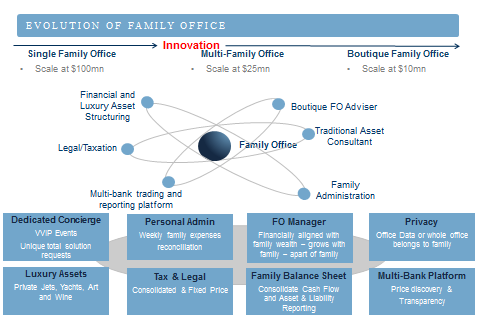

Types of Family Office

Family offices are generally categorized as either a single-family office, multi-family office, or a virtual family office.

A single-family office (SFO) is created to serve a specific family group, with a general threshold, (generally speaking) of USD$100 million or more investable assets.

A multi-family office (MFO) is an organization that provides family office services to more than one family group. It provides similar services to that of a single-family office, but one advantage of which is that there is no need to set up a separate family office infrastructure, making the entry level to such an office substantially lower, around the $25m to $50 million range. The benefit of reducing costs comes with other advantages such as increasing investment resources, streamlining due diligence on co-investment deals, and aggregating use of other infrastructure such as tax, legal, audit and family services.

Exclusivity and confidentiality increases when compared to being a member of a ‘private bank family office’ given the small number of families underpinning the Office. In turn, an MFO can bring to surface independence issues and reduce potential conflict of interest between different stakeholders working together as private family enterprises.

Virtual family offices (VFO) have started to be offered at the USD$10m level and above. What is meant by ‘virtual’ is essentially a website-based network set up exclusively for the management, governance, and communication needs of family wealth. The family’s trust advisor serves as the relationship manager who will assemble teams of individual professionals to serve and meet specifically the needs of the family.

The evolution of the family office: Innovation underpins the evolution of the family office model. Virtual offices are now able to mirror some of the services traditionally held for Single family offices, while multi-family offices can accommodate the tailored goals of separate families using investment bank and technology providers to maximise cost reductions and administration.

Today’s lower cost entry level illustrates the fact that technology and provision of services are the mainstay of a family office offering, rather than a certain amount of financial assets. In addition, by sourcing the different services such as lawyers, CPAs, Banks, etc., the MFO (and VFO) can function much like an SFO but with added efficiency, since every profession that is involved is a specialist within his respective field, whether working inside or outside an actual physical stand-alone (FO) office.